What is inflation and how to protect your money?

Even before the COVID-19 pandemic, rumours about the economic crisis, inflation, and other general financial downturn spread widely across the world. Although inflation in many European countries isn't greater than usual, even quite low, it is still happening and affecting various spheres of life. Therefore people constantly look for different ways to protect the value of their money in the long term.

What is inflation?

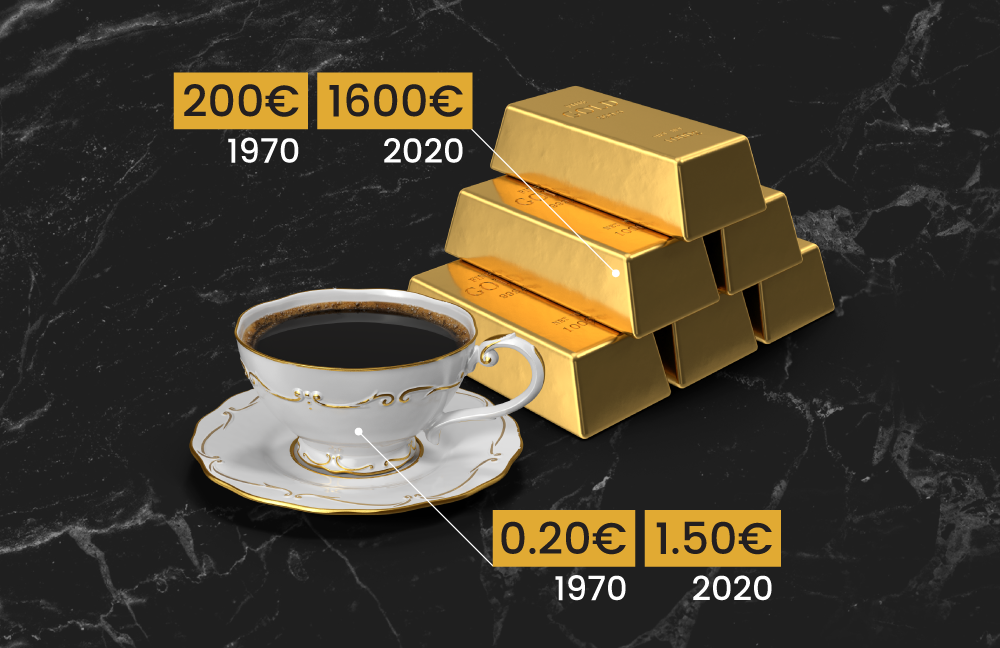

Inflation – the percentage by which the prices of goods and services increase. Likewise, it also works as a percentage by which fiat money loses its value. For example, in the 1970s a cup of coffee was 20 cents, today – it’s EUR 1.50. For the same amount of money now you can buy fewer goods than you could have done 50 years ago, because when prices increase – and we all notice this change – the purchasing power of money decreases.

Inflation is measured in CPI – consumer price index. It shows how much money one would spend this year buying the exact same products and services as last year.

Hyperinflation – a higher level of inflation, which is reached when prices of goods and services increase so much that it exceeds 50 per cent per year. One of the most well-known examples of hyperinflation is Venezuela, where inflation in September this year was 1813.1%.

Deflation – the opposite process of inflation, indicating that goods and services become cheaper. At first, this may sound like a good thing, however, it does not do any good to the economy. When prices drop, the state gets fewer taxes, businesses generate less money, debts don’t change, and as a result, it often leads to insolvent people and companies, economic crisis, and other negative outcomes.

Is inflation normal?

A mature market records a normal annual inflation of 1-3 per cent. Inflation of emerging markets can be slightly higher and reach 2-8 per cent.

Due to this predicted and controlled inflation, our salaries, as well as welfare and other benefits, increase annually. It happens because every year for the same amount of money people can buy slightly fewer goods.

However, all of us feel inflation in different ways, and we are all affected differently, since we all use different goods and services in different proportions. For example, if your rent makes up for almost half of your monthly spending and the rent price increases slightly – you will notice it a lot compared to someone whose rent makes up just a small amount of their monthly spending.

Infliacija Lietuvoje

Lietuvai įsivedus eurą, infliaciją reguliuoja Europos Centrinis Bankas. ECB siekia, kad infliacija Lietuvoje ir kitose šalyse būtų apie 2 proc. Iki tol, išskyrus kelerius metus, infliacija Lietuvoje būdavo didesnė.

Infliacija nustatoma stebint pagrindinių prekių ir paslaugų kainų pokyčius. Dažnai vienos kainos krenta, kitos kyla, tad vieni žmonės kainų pokyčius pajunta labiau nei kiti. Pavyzdžiui, Lietuvai įsivedus eurą oficiali statistika rodė, jog vidutinės kainos sumažėjo beveik procentu, didelės infliacijos Lietuvoje nebuvo, nors daugelis žmonių pajuto prekių pabrangimą. Vis dėlto, tokią statistiką tuo metu lėmė kiti veiksniai – atpigusi nafta, kviečiai, pieno produktų perteklius dėl Rusijos embargo ir pan. Šios prekės itin svarbios kasdienio vartojimo krepšeliui ir tuo metu paslėpė kylančias kitų prekių ir paslaugų kainas.

How to protect your money from inflation?

Wealthy people and profitable companies often look for different ways how to protect their money from inflation. Many choose to invest in real estate or shares hoping not only to protect their money but also to make it work.

Others fear the risk of losing money and at least for part of their money choose a safer and time-tested method of preserving the value of money – gold. And although the price of gold constantly fluctuates – in the long term it has an upward trend, just like inflation.

At the beginning of the article, we mentioned that in the 1970s a cup of coffee was 20 cents, and today – it’s EUR 1.50. Well, an ounce of gold in the 1970s was EUR 200, today it’s more than EUR 1600.

Looking at the statistics it is rather clear why for short-term investments and quick return people choose real estate or securities, but in the long term ( at least 10 years) when seeking to preserve the purchasing power of money – gold becomes a great way to diversify the investment portfolio. And since gold prices are affected by different factors than, for instance, real estate, wealthy people often choose to have at least part of their savings in gold.

Moreover, keeping savings in gold becomes more and more viable for regular people. For instance, Paysera clients can simply buy gold bullion or even gold in small parts via the app and pick it up or sell it back at any time.

November 2020 • 2 min read

Protect your money – go for gold!

A cup of coffee in the 1970s was 20 cents, today – it’s EUR 1.50. Meanwhile, an ounce of gold in the 1970s was EUR 200, today – it’s more than 8 times that price. What do these two commodities have in common, you may wonder? Inflation.

Read more

November 2020 • 2 min read

Fintechs and physical gold? They're compatible, especially now

Paysera’s co-founder and main shareholder shares his thoughts on the coexistence of two things which at first might appear incompatible – online fintechs and the physical gold market.

Read more

October 2020 • 4 min read

Gold purity, fineness, and karat – what is it and how to check it?

What do numbers describing gold purity mean? What is the difference between karats and fineness? Can you find 100 per cent gold? And how do you check the fineness of gold?

Read more