How to make Bulgarian and Romanian Budget Payments from a Paysera account

Did you know that through Paysera you can pay your tax obligations to the State Budget both in Bulgaria and Romania? If not, we have some good news for you. Read this article to learn all about budget payments via Paysera.

Please be advised that for all kinds of Budget Payments we recommend you consult with your local Accountant.

Bulgarian Budget Payments

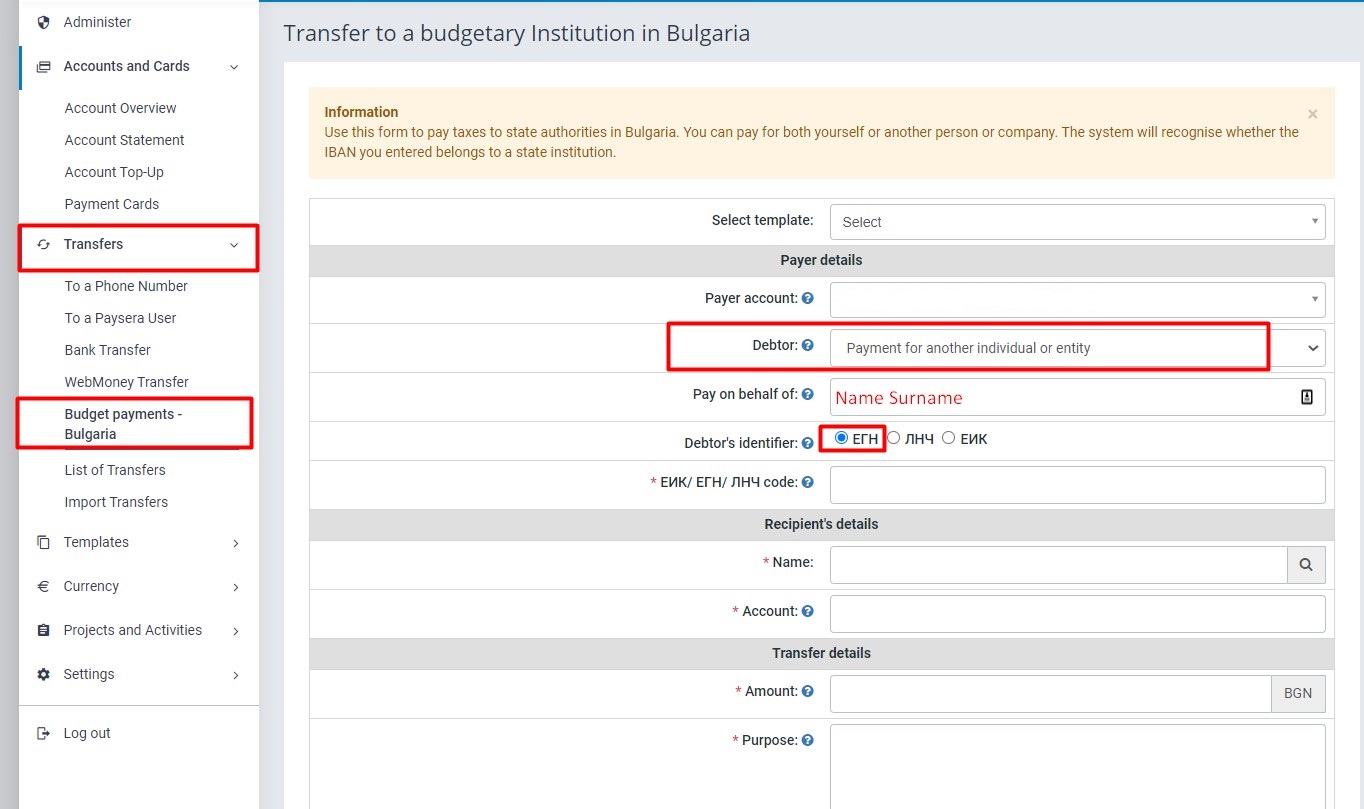

For Bulgarian Budget Payments, you need to access on the left menu Transfers -> Budget Payments – Bulgaria.

1. If the Payer is a Non-Bulgarian Individual who needs to make a Payment to Bulgarian Fiscal Authorities (eg: Speeding Fine), the Payer will need to fill in the following fields in the dynamic Payment Form:

1.1. Payer details area

- Debtor field: need to choose Payment for another individual or entity

- Pay on behalf of field: insert Name and Surname of the Payer

- Debtor’s identifier field: check ЕГН

- ЕИК/ ЕГН/ ЛНЧ code field: insert “1111111111” – ten digits

1.2. Recipient's details area

- Name field: insert name of the Fiscal Authority

- Account field: insert IBAN account of Fiscal Authority

- Recipient’s bank SWIFT/BIC: it will be filled automatically by the system based on info from Account field

- Recipient’s bank: it will be filled automatically by the system based on info from Account field

1.3. Transfer details area

- Amount field: insert amount

- Purpose field: insert payment details

1.4. Additional information about the recipient area

- Document type: choose 6 – Debt recovery orde” or 9 - Other

- Document No.: insert Serial & Number of the document

- Document date: insert Date of issue of the Document

Press Continue in the lower-right corner, and in the next window check the info shown. After reviewing the info, you can Sign the transfer.

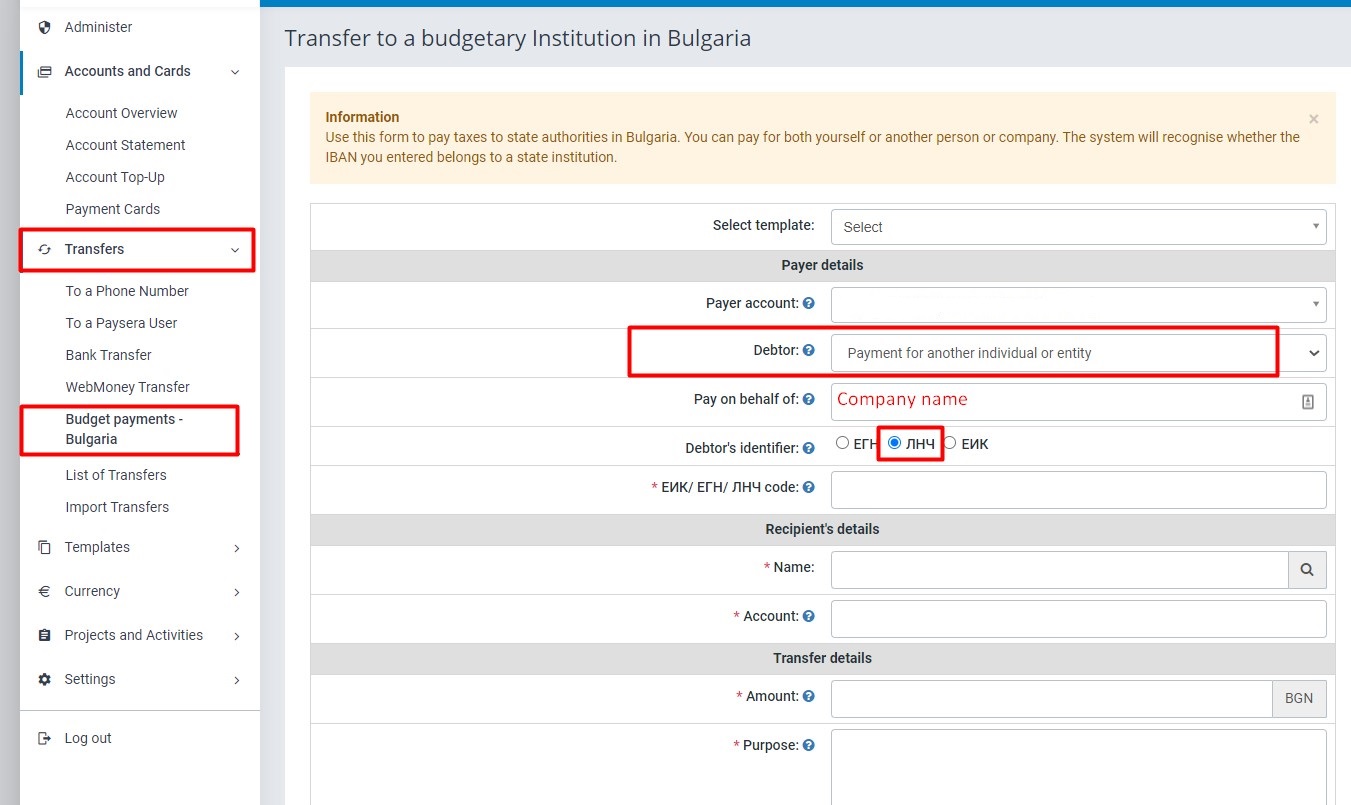

2. If the Payer is a Non-Bulgarian Business that needs to make a Payment to Bulgarian Fiscal Authorities (eg: VAT Payment), the Payer will need to fill in the following fields in the dynamic Payment Form:

a. Payer details area

- Debtor field: need to choose Payment for another individual or entity

- Pay on behalf of field: insert Name of the Company

- Debtor’s identifier field: check ЛНЧ

- ЕИК/ ЕГН/ ЛНЧ code field: insert your Company Bulgarian Fiscal number allocated by Bulgarian Authorities

b. Recipient's details area

- Name field: insert name of the Fiscal Authority

- Account field: insert IBAN account of Fiscal Authority

- Recipient’s bank SWIFT/BIC: it will be filled automatically by the system based on info from Account field

- Recipient’s bank: it will be filled automatically by the system based on info from Account field

c. Transfer details area

- Payment type code: insert Code according Budget Account identifier (for example: “110000” for VAT payments)

- Amount field: insert amount

- Purpose field: insert payment details

d. Additional information about the recipient area

- Document type: choose 1 - Declaration or 9 - Other

- Document No.: insert Serial & Number of the document

- Document date: insert Date of issue of the Document

- Date from: insert first day of the period

- Date to: insert last day of the period

Press Continue in the lower-right corner, and in the next window check the info shown. After reviewing the info, you can Sign the transfer.

Romanian Budget Payments

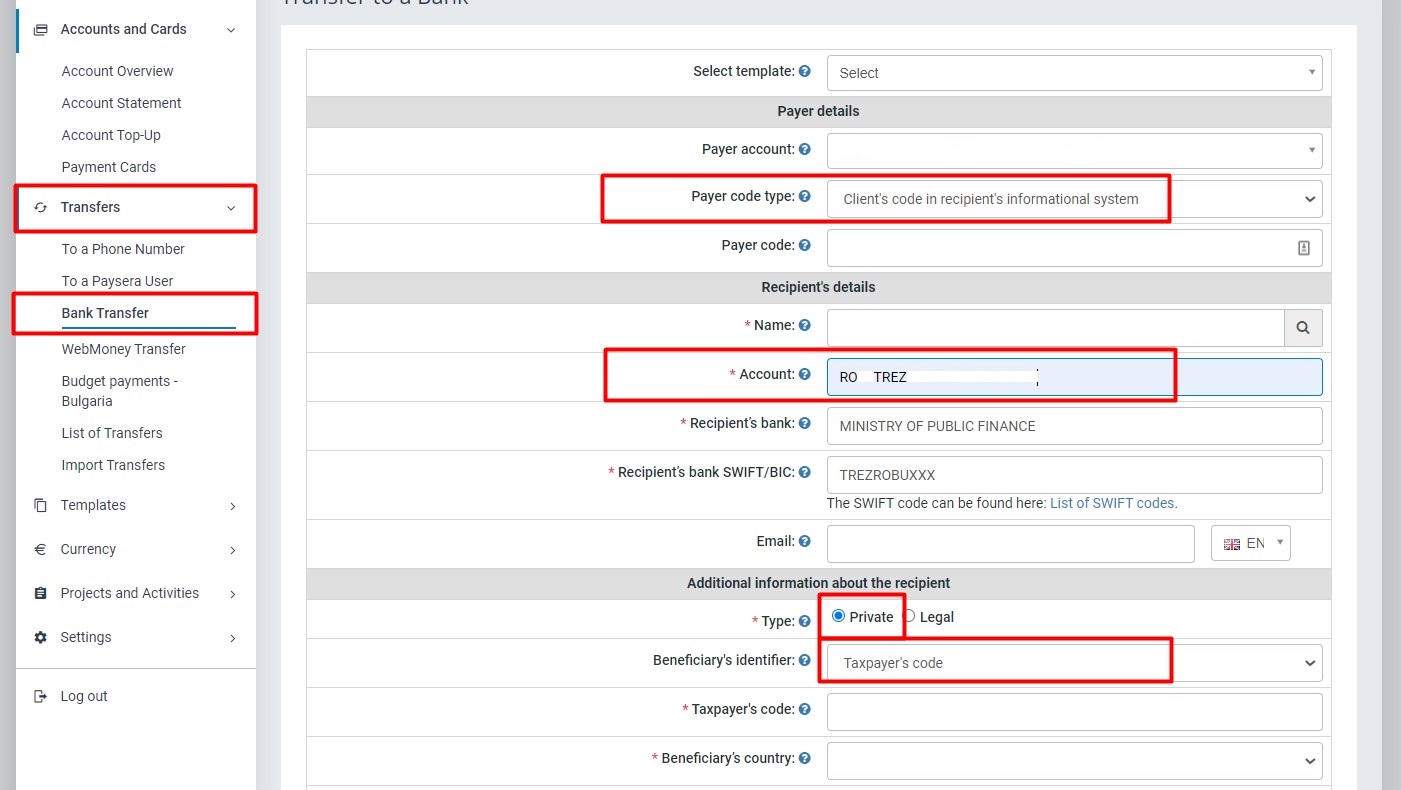

For Romanian Budget Payments, you need to access on the left menu Transfers -> Bank Transfer.

A. If the Payer is an Individual who needs to make a Payment to Romanian Fiscal Authorities (eg: Local Taxes), the Payer will need to fill in the following fields in the dynamic Payment Form:

2.3. Payer details area:

- Payer account field: leave it as it is.

- Payer code type field: from the drop-down menu, choose Client’s code in the recipient’s informational system.

- Payer code field: insert your Romanian fiscal code (without any prefix, just numbers)

2.4. Recipient's details area

- Name field: insert the name of the Fiscal Authority

- Account field: insert the IBAN account of Fiscal Authority, mandatory as ROxxTREZ

- Recipient’s bank SWIFT/BIC: it will be filled in automatically by the system based on info from the Account field

- Recipient’s bank: it will be filled in automatically by the system based on info from the Account field

2.5. Additional information about the recipient area

- Type: if you are making a payment as an Individual, check Private

- Recipient's identifier: mandatory to select Taxpayer’s code

- Taxpayer’s code: insert your Romanian Individual Fiscal Code, or Personal Identification Number (13 Digits)

- Recipient’s country: choose Romania

- Recipient's city: fill in with the name of the city of the Fiscal Authority

- Full address: fill in with your Romanian address

2.6. Transfer details area

- Amount field: insert amount

- Purpose field: insert payment details

Press Continue in the lower-right corner, and in the next window check the info shown. After reviewing the info, you can Sign the transfer.

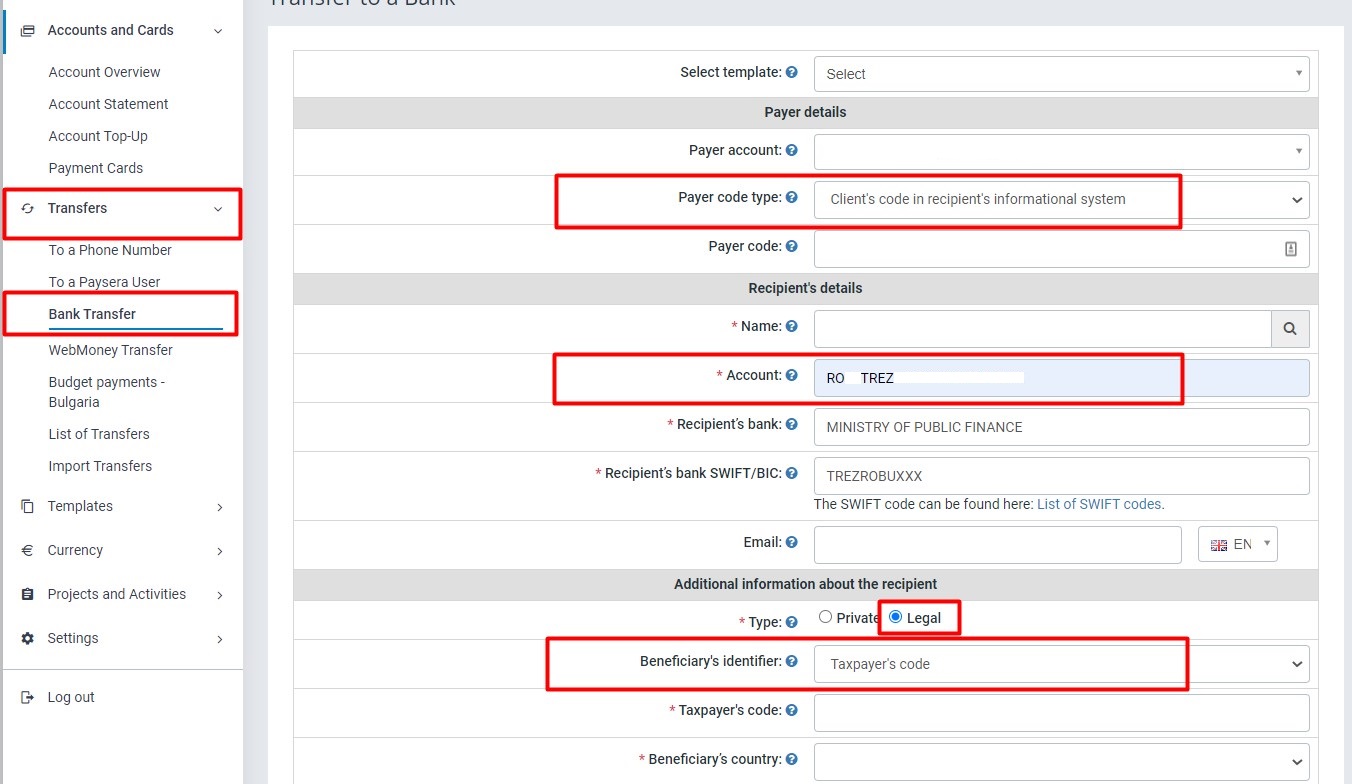

B. If the Payer is a Legal Entity that needs to make a Payment to Romanian Fiscal Authorities (eg: VAT Payment), the Payer will need to fill in the following fields in the dynamic Payment Form:

2.6. Payer details area:

- Payer account field: leave it as it is.

- Payer code type field: from the drop-down menu, choose Client’s code in the recipient’s informational system

- Payer code field: insert your Romanian fiscal code (without any prefix, just numbers)

2.7. Recipient's details area

- Name field: insert the name of the Fiscal Authority

- Account field: insert the IBAN account of the Fiscal Authority, mandatory as ROxxTREZ

- Recipient’s bank SWIFT/BIC: it will be filled in automatically by the system based on info from the Account field

- Recipient’s bank: it will be filled in automatically by the system based on info from the Account field

2.8. Additional information about the recipient area

- Type: if you are making a payment as an Individual, check “Legal”

- Recipient's identifier is mandatory to choose “Taxpayer’s code”

- Taxpayer’s code: insert your Romanian Individual Fiscal Code, without “RO” prefix

- Recipient’s country: choose “Romania”

- Recipient's city: fill in with the name of the city of the Fiscal Authority

- Full address: fill in with your Romanian address

2.9. Transfer details area

- Amount field: insert amount

- Purpose field: insert payment details